|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

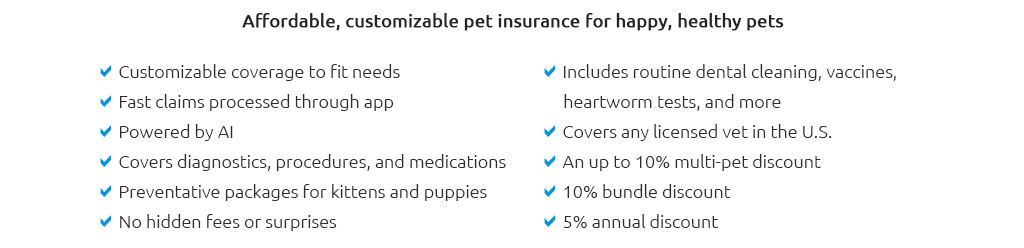

Compare Pet Insurance for 2 Cats: A Comprehensive GuideChoosing the right pet insurance for your feline friends can be a daunting task. With numerous options available, it's essential to find a plan that suits both your cats' needs and your budget. This guide will help you navigate the process with ease. Understanding Your Cats' NeedsBefore you start comparing insurance plans, consider your cats' specific health needs. Are they indoor or outdoor cats? Do they have any pre-existing conditions? Understanding these factors can significantly impact your decision. Indoor vs. Outdoor CatsIndoor cats generally face fewer risks compared to outdoor cats, which may affect the type of coverage you choose. Outdoor cats might need more comprehensive plans due to increased exposure to accidents and illnesses. Age and Breed ConsiderationsAge and breed also play a significant role in determining insurance costs. Certain breeds are prone to specific health issues, and older cats may have higher premiums. Comparing Insurance ProvidersWhen comparing pet insurance providers, consider the following key factors:

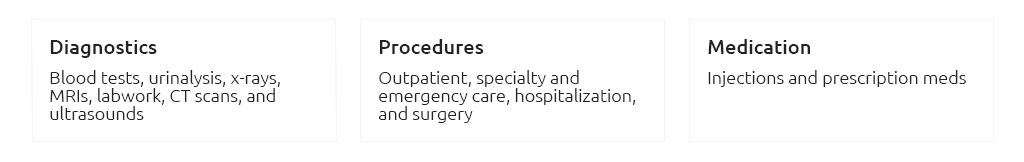

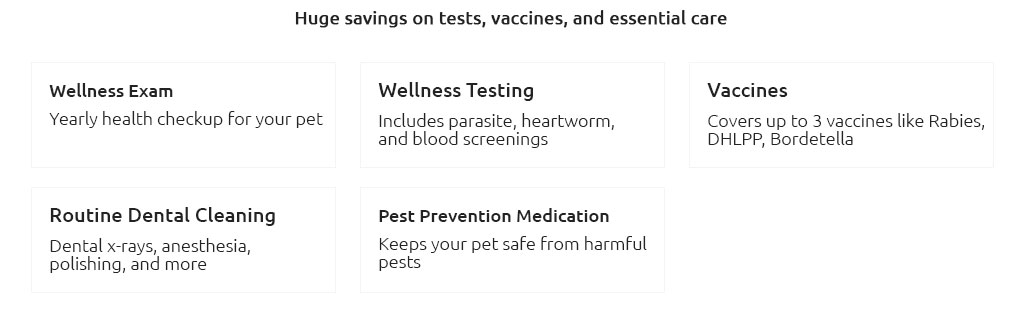

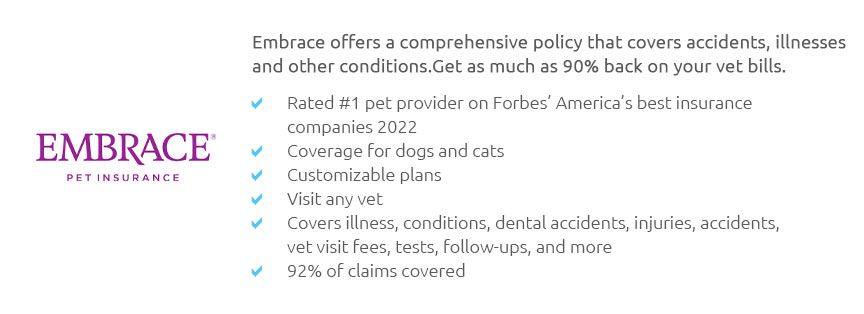

For a detailed comparison, check out this pet insurance for 2 kittens resource. Evaluating Plan BenefitsDifferent plans offer various benefits, such as wellness care, dental coverage, and prescription medications. Assess whether these benefits align with your cats' current and future health needs. Additional PerksSome insurance plans offer perks like multi-pet discounts or coverage for alternative therapies. These can add value and save money in the long run. Making an Informed DecisionOnce you've gathered all the necessary information, compare the plans side by side. Consider both your budget and your cats' health requirements to make an informed decision. Remember, the cheapest option isn't always the best. If you have other pets, like dogs, you might be interested in exploring pet insurance for 3 dogs to see if multi-pet policies offer better rates. FAQsWhat does pet insurance typically cover?Most pet insurance plans cover accidents, illnesses, surgeries, and medications. Some may also cover routine care and wellness checks. Is it better to insure both cats under one policy?Insuring both cats under one policy can be beneficial, often resulting in discounts. However, ensure the policy adequately covers each cat's needs. How can I lower my pet insurance premium?Consider increasing your deductible, opting for a plan with fewer frills, or looking for multi-pet discounts to lower your premium. https://www.pawlicy.com/

Over 2,438,795+ dogs and cats have pet insurance across the U.S.. Get Quotes ... https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

An illness, disease, injury or change to a pet's health that first occurs or shows signs 1) before coverage is effective or 2) during a waiting period. This. https://www.petinsurance.com/pet-insurance/multiple-pets/

The monthly premium depends on the type of coverage selected but starts at around $10/month for two cats, which includes a 5% multi-pet discount. How ...

|